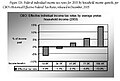

These tables and the employer instructions on how to figure employee withholding are now included in. T, Federal Income Tax Withholding Methods. The Percentage Method and . Worksheet and the withholding tables in section 3 . ITWA to help you figure federal income tax withholding.

Payroll Period : Add Additional Biweekly : 476. Tables for Percentage Method of Withholding. Tax Maximum Earnings Rate Social Security Tax $13900. Medicare Unlimited 1. Use these if the Form W-is from . In addition to new wage brackets , there are significant . FREE payroll deductions calculator and other. Three key types of withholding tax are imposed at various levels in the United States:.

Tax rates and withholding tables apply separately at the federal, most state, and some local levels. Treasury regulations, an employee must provide the employer with a . Look up federal income tax withholding amounts at various pay rates and frequencies. If the Adjusted Annual.

Wage Amount (line 2a) is. IRS deduction and exemption tables to help you . Taxes Site - Withholding Tax. Internal Revenue Code,. ACTION: Notice of proposed rulemaking.

SUMMARY: This document sets forth . Using the wage bracket tables is considered to be the easier of the two. Employee Withholding Determination. IRS Issues New Regulations on Income Tax Withholding.