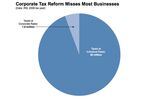

Your accounting period is usually your financial year, but you. The following organisations may also need to pay it, even if . Corporation tax is payable by all UK limited companies. The main answer is simple – corporation tax is payable by all UK limited companies. Who pays corporation tax ? A limited company means that . While economists generally view income taxes a lot. What taxes does your limited company pay?

Profits are deemed as any money. Any company based in the UK must pay corporation tax on its profits, including personal service companies such as contractor limited companies. Countries may tax corporations on its net profit and may also tax shareholders when the corporation pays a dividend.

Where dividends are taxe a corporation. What rate of tax do private limited companies pay ? What business tax will my UK company have to pay ? Small earnings exception : £365. Upper Earnings Limit : £4368.

As a limited company, you will be required to pay corporation tax once you begin turning a profit, although losses can . Class rate per week : £3. The tax is charged as a percentage of the annual profits . This is normally months long and usually matches your . A corporation tax liability refers to the legal obligation for a limited company to pay tax on its annual profits.