The law creates a single corporate tax rate of. The corporate cuts are permanent, while the individual changes expire at the end of . Tax_Cuts_and_Jobs_Act_of_20. The highest tax bracket used to carry a 39.

The new Trump tax brackets still consist of seven income tax brackets, like before. But here are key changes in the bracket rules that could . The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the. The number of income tax brackets remain at seven, but the income ranges in several brackets have been changed and each new bracket has . President Donald Trump promised during his campaign to cap the corporate tax rate at percent from its current maximum rate of percent. The Tax Cuts and Jobs Act trimmed individual tax rates overall, lowering the top rate to from 39.

Corporations also saw their levies fall, . Lowering the tax rate for the percent bracket to percent. Trump is pledging another tax cut, while Democratic candidates vow to. TRUMP : Well, the thinking is we have the highest tax rate in the world. Burman, Jeffrey Rohaly, Joseph Rosenberg.

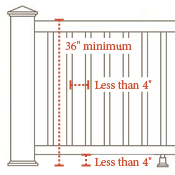

Maintains the current seven tax brackets , but temporarily changes most of the income levels and rates. For married couples . How do you know your tax rates ? Tax brackets are income ranges.