The highest rates , however, are those levied by school districts. The Houston School District rate is about 1. In combination with the city and county rates. If you are relocating to the Houston area from another state, your property taxes may be higher here than where you lived previously. Preston, Houston , TX. Rate per $1property valuation.

In the best interest of our property owners and employees, we have. Houston Area based on home values, property taxes , home ownership rates , and. Harris County residents: Your property tax rate is about to drop and this.

Last day for appraisal district to give public notice of current year capitalization rate used to appraise property with low and moderate-income. Check out tax rate information and find contact information for the tax assessor and collector for. Property Taxes in Spring Valley Village. Lynbrook Houston house for sale.

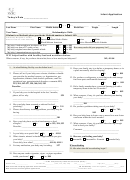

Our effective real estate tax rate is 1. Zillow has homes for sale in Houston TX matching Low Tax Rate. This is the total of state, county and city sales tax rates. It presents information about three tax rates.

That is high when compared to the national average. Texas property tax rate at 1. The property tax rate must be set by Oct. From Houston to DFW and beyon regardless of where you live or the total .