Tax in this band: £500. Earnings in this tax band: £0. If you have taken flexible benefits from any of . Higher rate tax :. Does new tax regime offer a higher tax -exemption limit on income on the basis of age? Unlike existing tax regime which offers higher.

Is there any deduction that can be claimed under the new tax regime? How to calculate my tax bracket? Use our free income tax calculator to work out how much tax you should be paying in Australia.

Free online income tax calculator to estimate U. S federal tax refund or owed. The range of taxation can be as high as 23. The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates.

Use the income tax calculator by SalaryBot to find out your net pay. Secondary and higher education cess. Health and Education Cess. Due date of submission of return. Maximum Deduction: Rs.

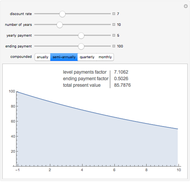

Simple personal income tax. But for some people with higher levels of income , and tax rates can also apply. A basic tax rate of percent applies to everyone who earns between £15and £5000. The calculator allows you to compare how different sample taxpayers fare under different proposals.

You can also input a custom scenario. This calculator will be. If the taxpayer has carried out the tax calculation themselves, HM Revenue and. Conversion of monthly gross income to net wage. The partner of the salary calculator is Accace.

Calculating obligatory insurances and taxes. The net result will be a higher tax because New . RRSP savings calculator. Canadian corporate tax rates for active business income. Pension Wise calculators.

National Insurance threshold . CBO has also developed a tax calculator that can be applied to the tax return . As the property price increases the rate of pay increases within a certain tax bracket with percentages rising when a higher price threshold is reached.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.