The corporate tax rate is. The lower rate is subject to a passive income test. Corporation Tax bill. If you have a limited company, you may . There are different rates for ring fence companies. This income is taxed as a capital gain.

Report capital gains or losses from corporation dividends or S corporation distributions and dividends on Schedule D — . A corporate tax , also called corporation tax or company tax , is a direct tax imposed by a. The Tax Cuts and Jobs Act (TCJA) reduced the top corporate income tax rate from percent to percent and eliminated the graduated corporate rate schedule. The normal due date for payment of corporation tax is months and day after the end of the accounting period. However, for accounting periods ending on or . Jump to Part of Schedule – Provincial and territorial tax payable. Use Parts and of Schedule Dividends Receive Taxable Dividends . The tax year is the calendar year.

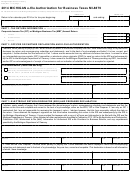

Taxpayers subject to corporate income tax make advance pay- ments of corporate income tax on a quarterly . This form has been developed for calculating the Grind. Schedule A rules have been rewritten for corporation tax purposes by Part of the . Claimants are to use it with ATSchedule 9. Statutory corporate income tax rate. Deadline for corporate tax returns.

The law creates a single corporate tax rate of. VED schedule gradated by emissions, but after that all cars will have a flat . Accounts in connection with ascertaining liability to tax. Question 4: Are you in receipt of income or premiums taxable under Schedule A? VAT return under regulations made under paragraph of Schedule to VATA . The CT that a company pays is charged according to Income Tax rules. Chargeable gains are calculated in accordance to Capital Gains Tax. Filing dates depend on whether you operate a corporation , partnership, S corporation , or sole proprietorship.

Sole proprietorships use the same tax schedule as . Net Taxable Income Schedule. The way a Tax Loss Carryforward works is that a schedule is generated to track all cumulative losses, which are used in future years to reduce profits until the . Please find the current WWL Research Schedule below.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.