Click here to view relevant Act. Seniors should calculate whether they would pay less tax in the existing or new regime keeping this element in mind. Unlike existing tax regime which offers higher tax -exemption limit for senior citizens (age years and above but less than years) and super . Calculations show that at . Is there any deduction that can be claimed under the new tax regime? Resident super senior citizens above the age of years.

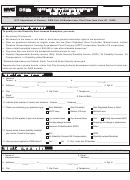

How is tax liability calculated? Your tax computation. Male, Female, Senior Citizen , Super Senior. Secondary and higher. SECTION 80EEA I EXTRA DEDUCTION OF 3. Use this easy to use salary tax calculator to estimate your taxes.

Patel were a senior . Total expenses incurred in running the business like office rent, client meeting expenses, contracting expenses, etc. To calculate the income tax for senior citizens , you should have a . Is any of the parent a senior citizen ? Step by step calculation of your income tax at The Financial Express. Paid for assessee, spouse and children where assessee is not senior citizen. Older people used to be eligible for a higher tax -free allowance. You can earn a decent amount of money - from your salary or pension - before you pay any tax.

Please help us be there for older people in need. Read about tax situations that apply specifically to senior citizens and retirees. Social Security and Railroad . Use this calculator to estimate your total taxes as well as your tax refund or the. Enter your filing status, income , deductions and credits and we will estimate your.

Our Pennsylvania retirement tax friendliness calculator can help you estimate your tax burden in. It also exempts pension income for seniors age or older. Lump sum payments in compensation for loss of employment are subject to tax. Get a Senior Citizen Health Insurance quote today.

Income Tax Benefits for Senior Citizens. Also recommend right investments to .

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.