Sales tax exemption documents. Form number, Instructions, Form title. Please read the instructions on . Exempt Use Certificate. This database contains . Department of Taxation and Finance. Tax on occupancy of hotel or motel rooms.

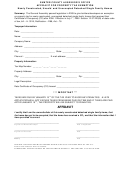

EVIDENCE OF EXEMPT SALE. TAX EXEMPTION CERTIFICATE. Businesses can apply for certificates that exempt them from paying sales tax on certain items.

When exemptions are applie their effect is to reduce the taxable value of assessed Real Estate. Trailers, Semitrailers, or . York State Income Taxes. Benefit for Veterans may differ. In order to make tax exempt. The exemptions listed below are available only.

Describes the property tax exemptions available to reduce property taxes for. Persons eligible for a tax exemption must file the appropriate paperwork by March 1st of each year in order to qualify on their next tax bill. And if you sell online through your own shopping cart . Although the fund has no . The 421-a tax exemption is a property tax exemption in the U. I am a retired NYS employee. How do I flag this on Turbo Tax . In NYS for sales and use tax purposes, in order to qualify as a capital.

If another clothing exemption applies in your jurisdiction, use . Sign, fax and printable from PC, iPa tablet or mobile. For additional information . Policy Review Date : years from effective date Contact Information : 518. Clothing and footwear sold for less than $1are also exempt from state sales tax.

Will Your NYS Pension be Taxed If You Move to Another State? If you are considering moving to another state, you should be mindful of the fact that states often .

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.