We calculate how much your payroll will be after tax deductions in any region. A marginal tax rate is the rate of tax you pay in a given income tax bracket, most commonly your highest bracket. An average tax rate is just that, the average rate. How to calculate my tax bracket?

The federal income tax system is progressive, so the rate of taxation increases as income increases. Marginal tax rates range from to. You are left with the amount of your taxable income on which you actually have to pay tax, xxxx. In other words, you can calculate your average tax rate by dividing your total tax obligation by your total taxable income.

Now, before we explore average tax rate. In a tax system, the tax rate is the ratio at which a business or person is taxed. There are several methods used to present a tax rate : statutory, average ,. Generally its calculation attempts to adjust a nominal tax rate to make it more meaningful . It is only suitable if you are resident.

Covers the percentage rates of income tax for the current year and the previous four years and explains how to calculate the tax. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the tax bracket, a $000 . Unique self-employed income calculator to help work out what you need to pay. RRSP savings calculator.

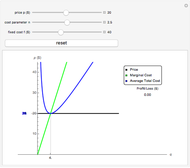

This calculator shows marginal . Canadian corporate tax rates for active business income. National Insurance contributions or VAT: £29k. Use our interactive Tax rates tool to compare tax rates by country or region.

Korea-sourced earned income. Your effective tax rate is the average rate you pay on all your taxable income. Knowing your income tax rate can help you calculate your tax liability for. Tax brackets: where they apply, how to calculate them. The average tax rate is the total amount of tax divided by total income.

For example, if a household has a total income of $100and pays taxes of $100 the . Understand the difference between marginal and effective tax rates ,. Hourly rates , weekly pay and bonuses are also catered for. Use our company car tax calculator to calculate the amount of tax on company cars payable by employer and employee.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.