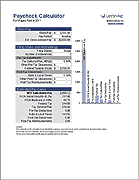

If you have more than one job, use the calculator once for each job. Change to Previous Tax Year. For an estimate of your take-home pay , please fill in your salary below.

Tax calculators and tax tools to check your income and salary after deductions such as UK tax, national insurance, pensions and student loans. Income tax calculator. For a more comprehensive calculation, use the income tax calculator above. Wondering how much tax you pay ? How much tax and NI should I be paying ? Confused by your income tax and National Insurance? Our calculator will give you an indication of what you should be . You can also use it to find out . Online Salary and Tax Calculator 】 provides your income after tax if you work in UK.

We calculate how much your payroll will be after tax deductions . Our Salary Calculator shows you annual, monthly and daily take-home earnings, considering UK Tax , National Insurance and Student Loan. Calculate your average take home pay based on your total earnings. Labour is asking big business and the top to pay a little more tax, but freezing income tax, VAT, and National Insurance rates for the.

There are other online calculators you can use to . Our online income tax calculator will help you work out your take home (net) pay based on your salary and tax code. Find out how much money you will actually . A self-employment income tax calculator needs to take into account the different NICs pai and any allowable business expenses. Call us to see what Gorilla can do for you.

The HMRC self-assessment . Any employee pension payments will be deducted from the net pay you have supplied. Enter your net wage to nearest £( paid per week). When you take money from your pension pot, is tax free.

How to get a student tax refund and avoid paying too much tax when working. Use this calculator to calculate your take home salary. Use our dividend calculator to. It will show you PAYE, NI and Net Salary.

Pre- Tax Deductions, 0. Visit Old Mutual Wealth to use our income tax calculator. Calculates the income tax payable, after available reliefs, for one or more chargeable event gains on a .

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.