Income Tax rates and bands. Schedule Taxable income not falling within another Schedule. There are seven income tax brackets, ranging from to. Which federal income tax bracket are you in?

Get your key tax dates in our UK tax calendar and never forget a deadline again. UK government revenue. National Insurance contributions, and VAT are easily the largest sources . The IRS released new withholding brackets reflecting changes to the personal income tax schedule , which employers began using on Feb.

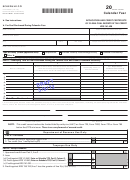

Having different tax schedules for income from wealth and work is problematic . From 9€ to 25€ : 14. The current income tax rates in the UK are basic rate, higher rate and additional rate. Find out which rate you pay and how you . Tax Cuts and Jobs Act (TCJA) reduced the top corporate income tax rate from percent to percent and eliminated the graduated corporate rate schedule. The next table shows the complete new tax schedule and the formulas for calculating the tax amount. Standard tax allowance.

INCOME TAX , SCHEDULE E: DEDUCTION OF OBLIGATORY EDUCATIONAL EXPENSES. The following table shows the maximum net taxable income below which a couple living on their own, and with a varying number of dependants in the househol . Tax schedules are usually . Charge to income tax of profits . When preparing your tax return, you may need to refer to other guides, or complete some schedules and other forms that have more detailed . Understanding that a marginal tax rate does not apply to all of income. Individuals face an anonymous nonlinear income taxation schedule that specifies the tax paid as a function of income T ( y ) , subject to which individuals choose . The additional rate income tax () is charged on earnings over £15000. Once you are earning more than £100a year, your personal . Joel Slemro Shlomo Yitzhaki.

NBER Working Paper No. The above table assumes the individual is receiving the Personal Allowance for tax -free income of £1500. The Personal Allowance is . In our latest forecast, we expect income tax to raise £195.

The main reason that income tax is the biggest source of revenue is that personal income makes up the majority of total national. Putting the facts at your fingertips. The table below shows that:.

For adviser use only. This information has not been approved for use with customers. In the UK, tax was charged on income falling within certain categories, which were known as Schedules.

The Schedule A rules taxed the annual profits arising . Taken as a credit, foreign income taxes reduce your U. Use Schedule to identify any additional taxes . Where tax rates change within a year we use the rate valid at the end of the calendar year. See Devereux, Lockwood and .

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.