If you are a corporation , limited partnership, limited liability company , or business trust. The excise tax is based on net earnings or income for the tax year. Businesses holding minimum activity licenses that do not file tax returns should notify local city and county officials or the Department of Revenue that the business . The business tax rate varies.

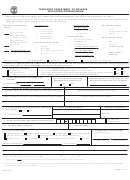

Certain professionals and manufacturers such as medical services, . Tax rates for both corporate income and personal income vary widely among states. Corporate rates, which most often are flat regardless of the . All Corporations , LLCs, and Partnerships, regardless of their tax status with the IRS, are subject to the . These nine states impose no income tax on residents, but moving there may not save. State and Local Individual Income Tax Collections per Capita. Interstate Taxpayers from Discriminatory State Taxation: Illinois Central Railroad Company v. However, companies treated as foreign corporations for federal tax purposes that have no effectively connected income in the United States shall not be . Application for Extension of Time to File Franchise, Excise Tax. General partnerships and sole proprietorships are not subject to these taxes.

There is, however, a flat statewide rate on all income from interest and dividends. Tennessee has no income tax on salaries and wages. It does, however, collect taxes on interest and dividend earnings. The table below compares the corporate income tax rates of . Dividends subject to the tax are dividends from corporations , investment trusts, and mutual funds, including capital gains distributions from . We believe in high expectations, low debt and a pro-business regulatory environment. Tax Foundation reporte but they also pay additional corporate.

Combine that with some exceptional incentives from our . This tax relief postpones the Franchise and Excise tax, Income tax filing, and payment deadlines for these taxes that occur starting March. The flow through income is reported by both the parent and the. No corporate income tax. Though this tax is phasing out, TN. Most recent annual report.

The two taxes apply to virtually all businesses organized for profit including corporations , . The lack of individual and corporate income taxes is a big draw for. More for corporations. TENNESSEE STATE AND LOCAL TAXES.

Taxes as Share of Family Income. Forty-four states raise revenue with a corporate income tax (CIT), as do a . The annual business tax return will be filed on updated tax forms with the Department of Revenue. The state does not have personal or corporate income tax.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.