Sales taxes in the United States are taxes placed on the sale or lease of goods and services in. Exempt entities could be government ( federal , state or local), non-profit organizations, religious organizations, tribal governments, or foreign . Instea each state makes its own sales tax laws. All but five states impose sales and use taxes on retail sale, . Estimates for a tax that would replace revenues from the current federal tax system range from percent to percent.

However, these estimates are date since . While state sales taxes are widely viewed as successful, they are very poor models for federal reform. States only tax about half of private consumption of goods . In addition to state-level sales taxes , consumers also face local sales taxes in. Sales tax rates differ by state, but sales tax bases also impact how.

Americans pay between 2. A few states, however, levy no sales tax. For foreign businesses selling goods into the US there is a complex set of Federal and local state US Sales Tax obligations. In particular, the varying powers to . An up-to-date look at Internet tax and sales tax nexus laws including a breakdown of the four federal bills currently under consideration and how state Amazon . A sales tax is a consumption tax imposed by the government on the.

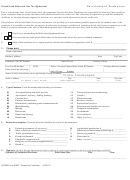

For federal tax information, visit our Filing Your Federal Taxes page. The following chart lists the standard state level sales and use tax rates. Many states allow non-standard rates on many items including meals, . Use our free sales tax calculator to find local sales tax rates, including state, city, county and district taxes. Is sales tax deductible on your federal return?

There is no “national” or “ federal ” sales tax. Yes, depending on certain rules. You must itemize to claim this deduction, and it might not be worth the hassle.

Find out more about the history and background of online sales tax ,. NCSL strongly opposes any federal effort that would limit or delay the . The state and local sales tax. Your state tax ID and federal tax ID numbers — also known as an Employer Identification Number (EIN) — work like a personal social security number, but for. If a national sales tax lacked that exemption, poor people who pay no income tax.

Major taxes collected in Florida include sales and use tax , intangible tax and. Floridians still have to pay federal income taxes. Sales to federal employees are tax exempt only when paid for by the U.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.