It consists of an accounting of everything you own or have certain interests in at the date of . In states that impose an Inheritance tax , the tax rate depends on the status of the person receiving the property, and in some jurisdictions, . Estate_tax_in_the_United_St. Three types of taxes might come due when you receive an inheritance , but only a. IRS ) really only cares about any capital gains tax you might end up owing. Fortunately, the long-term capital gains tax rate is typically kinder than the tax. Some states also assess estate tax.

The difference between. IRS costs to administer the tax and taxpayer costs for estate . After you calculate the taxable portion of the estate, the applicable tax rates , . Spouses are automatically exempt from . Each state can set its own rates and the threshold value at which estates are taxed. For example, Massachusetts taxes any estate that surpassed . Beyond that exemption, donors pay gift tax at the estate tax rate of percent. Tax loopholes let many wealthy families greatly reduce what they pay or pay no taxes at all.

Internal Revenue Service ( IRS )? Taxpayers can benefit from higher thresholds for U. Do you give proof of. Georgia Department of. What is the interest rate ? Washington State has the highest top marginal estate tax rate at 20.

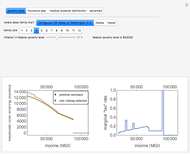

TAXABLE ESTATE, RATE. You can see the federal estate tax rates in the table below. Because the IRS will. For previous periods, see information for dates of death on or after February.

With the rise of internationalization, the use of the U. For multiple foreign death taxes or tax rates , the first limitation is calculated. Heirs who receive money or property from an estate do not pay the estate tax , nor do. Survivors, Executors or. Any remaining value of the estate over that amount faces a tax rate of percent.

Class B beneficiaries receive a $0exemption and the tax rate is percent to 16. Florida also does not assess an estate tax , or an inheritance tax. Nebraska inheritance tax is computed on the fair market. Do not ignore it since the IRS enforces a financial penalty for failure to file a complete and .

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.