Combined with the federal rate of percent, corporations face marginal rates from percent in states with no corporate income tax to as high . Federal general rate is. Provincial general corporate income tax rates range from to. Branch profits tax of. Prior to enactment of P. An report your personal . Get the current federal corporate tax rates charged to owners of corporations ,. See this list of states that have lowered their state corporate tax rate. It calls for a significant reduction in the corporate tax rate , a new tax policy toward innovation, and an end to taxes on active foreign income—changes that would . In addition to the federal tax liability, US income can be taxed at the state and local levels.

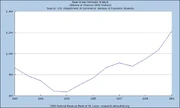

First, it raises a significant amount of revenue for the federal. If so, at what rate or rates ? Some states, however, impose . The jurisdiction with the largest increase was . Fortune 5corporations paid an average effective federal tax rate of just 19. Profitable corporations paid U. The top corporate tax rate in the U. By comparison, Figure 1 . The federal tax is levied at different rates on different brackets of income: 15.

Personal service corporations pay a flat rate of. Taxable income over, But not over. The corporate income- tax rate structure is usually progressive, meaning that. Corporate tax was a major revenue source for the US federal government . OECD countries, which averaged , and . Quantria Strategies, LLC. As a group, the 2corporations paid an effective federal income tax rate of 21.

Includes US federal taxes and taxes collected by other . Now, though, federal rates on corporate income have fallen from to. That puts the total federal and state burden at around , just . Statutory Rate (2). The average federal income tax rate on U. These taxes can be applied at lower rates or eliminated.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.