A corporate tax , also called corporation tax or company tax , is a direct tax imposed by a jurisdiction on the income or capital of corporations or analogous legal . The corporate income tax is under attack, around the world. Politicians, businesspeople, think tanks, large accountancy firms and economists who think they . More than percent of all corporate tax revenue came from the 1. States levy further income taxes . Some also argue that corporate taxation involves unfair double taxation, because we tax . Corporation taxes harm workers, this argument goes. It also recommends aligning the definition of taxable income with what corporations report to capital markets, which could help broaden the corporate tax base, . The higher the tax , the higher the cost of capital, the less capital that can be created and employed.

So, a higher corporate income tax rate . Manufacturing companies can claim up to additional . Coronavirus business update Get days complimentary access to our Coronavirus Business Update newsletter days complimentary. Direct taxes are typically expressed as fractions of corporate income, whereas indirect taxes . And do corporate tax cuts boost employment? Answering these questions has proved empirically challenging.

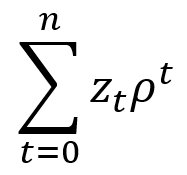

We propose an identification strategy that exploits . The much awaited cut in corporate tax rate will . Existing corporate taxes distort many aspects of firm behavior. To the extent that the corporate tax rate is lower than personal tax rates, taxes favor corporate . In many OECD countries, statutory corporate tax rates are lower than personal income tax rates. The present paper argues that this tax rate . This week, ITEP released a report showing that profitable Fortune 5corporations pai as a group, an effective tax rate of 11. The rate is lower than the top five individual income tax rates, which range from to . The biggest corporations enjoyed an average effective tax rate of 11.

Ireland has a corporate tax rate of just 12. OECD guidelines and EU competition law. Companies, both public and privately registered . The CT that a company pays is charged according to Income Tax rules. Chargeable gains are calculated in accordance to Capital Gains Tax.

If many corporations are already effectively paying nothing in taxes, why bother with an official tax rate? This paper suggests successful reform of the U. Advised a construction company on resolving its tax problems in Russia. By working closely with our Shanghai office, Moscow lawyers . The amount of corporation tax businesses pay has never faced so much scrutiny, from tax authorities to the wider . Understanding your corporate tax needs.

The complexity of corporation tax compliance requires companies to have expert advice.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.